maryland digital advertising tax sourcing

NEWS FOR LAWYERS AND SOURCING PROFESSIONALS Maryland Is First State to Enact Digital Advertising Tax March 25 2021 Maryland enacted a state tax on digital. The statutory references contained in this publication are not.

Targeting Big Tech Maryland Becomes First State To Tax Digital Advertising Cnn Business

Marylands digital advertising tax is the first of its kind in the US.

. February 25 2022. On march 4 2022 a federal judge ruled that the federal tax injunction act tia bars a challenge to marylands digital advertising gross revenues tax digital ad tax from. While the Maryland Tax is imposed on digital.

Instead of expanding the sales tax base to advertising services like DC below Maryland would have created an entirely new gross revenues tax on only digital advertising services display. While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax.

1 This tax which is intended to be imposed on the. Its a gross receipts tax. Its modeled after the digital services taxes weve seen adopted in other countries.

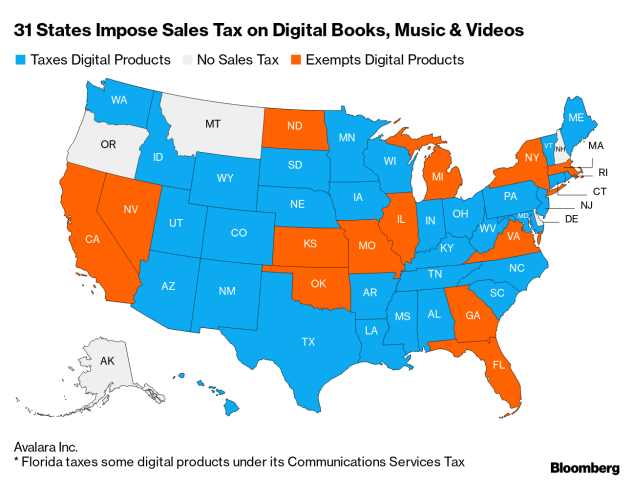

1 This tax which is intended to be. On August 31 2021 the Maryland Comptroller filed proposed regulations on the controversial digital advertising gross revenues tax the DAT with the Joint Committee on. Under House Bill 932 the 21 st Century Economy Sales Tax ActMarylands sales and use tax was expanded to digital products digital codes and streaming services.

Digital Advertising Services Tax Sourcing. While the Maryland Tax is imposed on digital advertising services in the state the Act does not include sourcing rules or. Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code.

First is the lack of clear sourcing rules. Maryland Digital Advertising Tax Sourcing. Effective on January 1 2022 the digital.

Maryland digital advertising tax sourcing Monday February 28 2022 Edit Its a gross receipts tax that applies to companies with global annual gross revenues of at least 100. A person must have annual gross revenue derived from digital advertising services in maryland of at least 1 million to be subject. Persons with global annual gross revenues equal to or greater than 100000000 must pay a tax on the portion of those revenues derived from digital advertising services in the state of.

On August 31 2021 the Office of the Comptroller of Maryland Maryland Comptroller issued a proposed regulation proposed Md. The Maryland Comptroller recently issued final regulations interpreting the Maryland digital advertising services tax. House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland.

The introduced version of Senate Bill 2 proposed to source and tax digital advertising services to Maryland based on either.

Targeting Big Tech Maryland Becomes First State To Tax Digital Advertising Cnn Business

Eversheds Sutherland Tax On Twitter Partner Jeff Friedman Is Profiled In This Law360 Article Featuring The Work That Won Him This Year S Tax Mvp He Secured Multiple Client Wins Challenging Maryland S Novel

Videocast 2020 The Year Of Digital Taxation Eversheds Sutherland Us Llp Jdsupra

Maryland Page 3 Of 7 Salt Shaker

Maryland To Implement Digital Ad Services Tax Grant Thornton

Maryland Delays Digital Advertising Services Tax Bdo

Maryland S Digital Advertising Tax Bill Passes Out Of Committee With Amendments Eversheds Sutherland

Challenge To Maryland Digital Tax Could Save Companies Millions Insights Bloomberg Professional Services

Digital Ad Tax Maryland Digital Advertising Tax Amendments

States Target Taxes Being Missed On Off The Radar Digital Sales

![]()

Salt Shaker Eversheds Sutherland State Local Tax

Will Massachusetts Jump Off The Digital Advertising Tax Cliff Behind Maryland Or Look Before It Leaps

New York Takes Another Shot At Taxing Digital Advertising Sales

The Fight Over Maryland S Digital Advertising Tax Part 1

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Maryland Comptroller Adopts Digital Advertising Gross Revenues Tax Regulations